To complete the e-filing process, taxpayers would no longer have to send the 1-page verification document ITR-V to the Income Tax Department in Bangalore .

They can instead verify their return

online after e-filing using an electronic verification code.

The Department has issued a circular with the instructions on Monday. The EVC generated is a 10-digit number unique to a PAN. This is valid for 72 hours only.

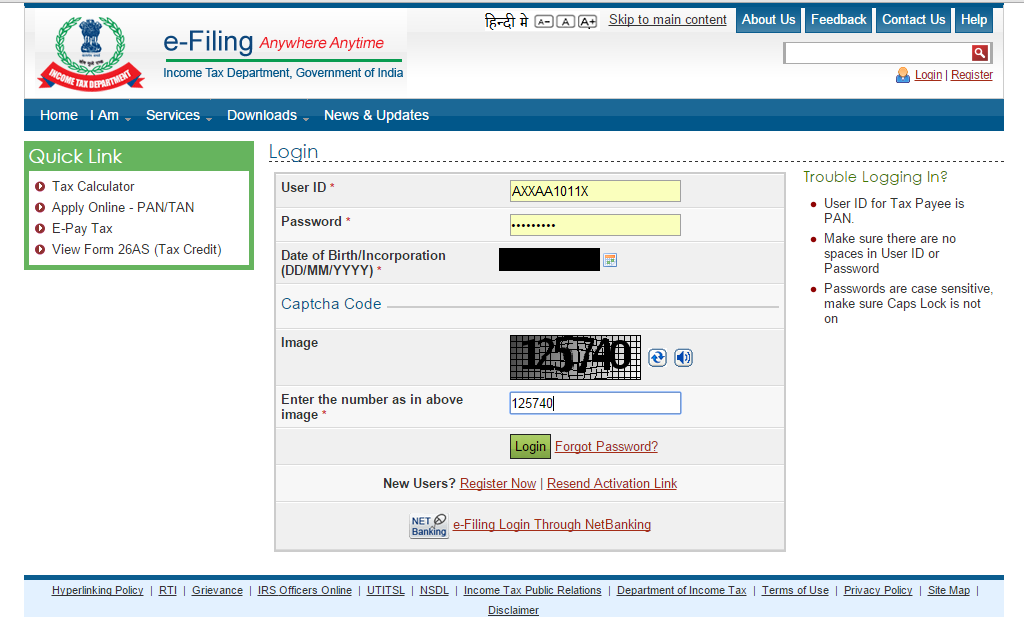

Step 1. Log on to the Department e-filing website.

Step 2. You can get the EVC code in two ways — through your Netbanking account, or through your registered email address/phone number. To get the EVC to youe email address/phone number, go to e-File tab and select “Generate EVC”.

Step 3. Enter the EVC sent to your registered email address/mobile number.

Step 4. Click on e-verify return under the E-file tab

You will see four options:

If you wish to get your ITR V please do write back to us at customer.support@taxmanager.in or call us at 09555331122