E-Verify Your Return Using Aadhaar Card

In order to e- verify your returns using an Aadhaar card, please make sure that your Aadhaar card is linked to your PAN Card.

Follow these steps to link your Aadhaar card to your ITR.

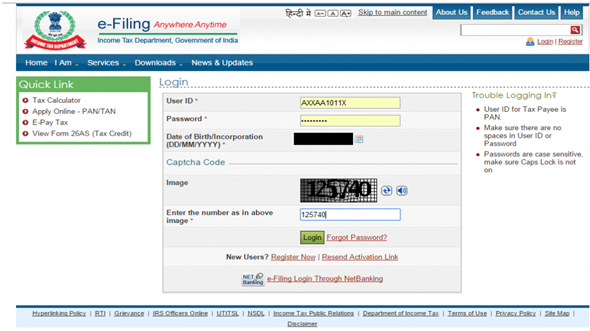

Step 1. Log on to the Department’s e-filing website www.incometaxindiaefiling.gov.in

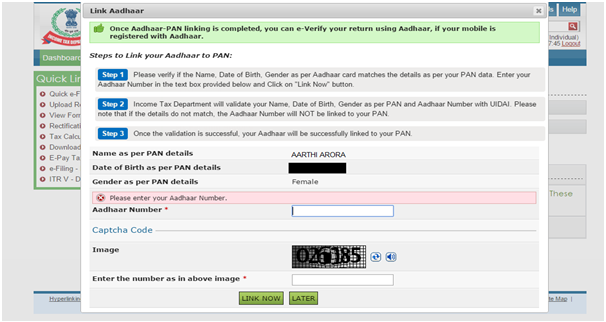

Step 2. As soon as you log in, a popup appears asking you to link your Aadhaar number with your e-filing account. If you don’t see the popup, go to the blue tab named ‘Profile Settings’ on the top bar and click on the ‘Link Aadhaar’ button.

Step 3. Check your PAN details and enter your Aadhaar number. Make sure you save these details by clicking the button that says ‘Save.’ Your Aadhaar number will be linked to your PAN after validation.

After your Aadhaar has been linked to your PAN, follow these steps to e-verify your returns :

Step 1: Upload your ITR through the Income Tax e-Filing website.

Step 2: Once this is done, you will be asked for the mode of verification for your returns.

You will see the following options:

• I already have an EVC to e-verify my return.

• I do not have an EVC and would like to generate EVC to e-Verify my return.

• I would like to generate Aadhaar OTP to e-Verify my return.

• I would like to send ITR-V/I would like to e-verify Later.

Select the 3rd-option that says – generate Aadhaar OTP. A one-time password will be sent to the mobile number registered with your Aadhaar; this OTP will be valid only for 10 minutes.

Step 3: Lastly, enter the OTP number on the page and hit ‘Submit.’

You will then receive a message that reads ‘ ‘Return successfully e-Verified. Download the Acknowledgement.’ The same acknowledgement will be automatically sent to your registered email id.

You have now successfully e-filed and e-verified your income tax return.