Founder and CEO

Deepak Kumar Jain

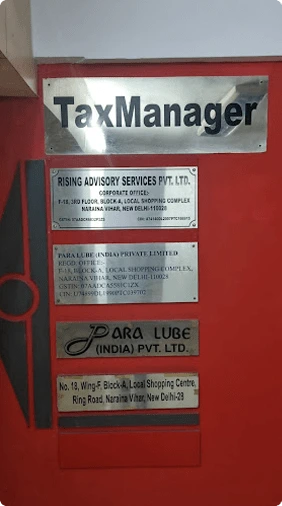

Chief Executive and Promoter of Rising Advisory Services Private Limited widely known as www.TaxManager.in – an e-Filing of Income Tax and Compliance Management Company. He is a PGDM holder from International Management Institute,

New Delhi in International Management along with qualified diplomas in the field of Finance. Hailing from a Chartered Accountancy family – audit, accounts and taxes has been flowing through his blood. Since his child hood he

was always fascinated with technology and the entrepreneur bug in him made him to do something out of the family backed profession. So after his studies he decided to start Rising Advisory having taxes, accounts and audit in

mind as business subject – he started the concept online CA Assistance under the brand name of eTaxesIndia.com in 2007.

With a vision of making Taxes and Compliance simple both for Individual and Corporate he architected www.TaxManager.in an online e-filing of income tax return and compliance management portal for individuals in 2009.

Since then under his leadership the brand has grown multiple fold times with a customer base of more then 2.2 lakh registered users and more than 30000 CA Assisted satisfied clients.

Under his leadership www.TaxManager.in has won prestigious awards like Business Leaders of Tomorrow – 2013 and 2014 from Economic Times and India Mart under SME Segment.

He has been instrumental in building relationship between TaxManager.in and HDFC Group and other financial institutions to provide tax services within the groups as to their employees and customer base. He has been also very active

in start up community and mentored few start ups to a big success stories.

He has experience in the field of finance and IT for more than 20 years and been leading the finance and audit teams of certain of Jain & Co, CA firm (well-known CA firm in India) before promoting Rising Advisory Services Private

Limited and TaxManager.in.