- IN THE NEWS X

- It’s time to clear your advance tax liability

- Seniors need to submit Forms 12BBA, 15G, 15H to save on TDS: Experts

- How investing in 54EC bonds can help you save tax on long-term gains

- New income tax forms are out for new assessment year 2022-23. Find out which one you should use

- New ITR forms need income disclosure from foreign retirement a/cs

- Why is March 31 an important date for taxpayers? Find out

- Not filed ITR yet? Face penalty or even jail term, say analysts

- March 15 Is The Last Date To Pay Advance Tax: Time To Clear Your Liability

- It's time to deduct TDS if rent exceeds Rs 50,000, say analysts

- Clarification on capital gains tax on early redemption of Sovereign Gold Bonds is required – Here’s why

- Second amendment to LLP Rules will ease procedural burden: Experts

- Three Things To Keep In Mind Before Investing In RBI’s Sovereign Gold Bonds

- Tackle low liquidity in sovereign gold bonds by laddering, say analysts

- CBDT, tax tools make e-filing of I-T returns simpler

The choice between the Old Tax Regime and the New Tax Regime Made Easy

Written by Gagandeep Arora - Printed on - Date - 4th April 2024

In the Union Budget of 2020, the New tax regime was introduced, It gave taxpayers a significant choice between the traditional and the newly established tax structures. The new regime offered lower tax rates and more tax slabs but did not allow taxpayers

to claim exemptions and deductions. This change led to confusion among taxpayers, who now face the task of evaluating the pros and cons of each regime. This shift has sparked considerable confusion among taxpayers,

prompting a careful evaluation of the advantages and disadvantages inherent in both tax regimes.

Let us dive into a comparative analysis of the old and new tax structures, examining their respective merits and drawbacks, and providing illustrative examples of tax liabilities under each regime. This

comprehensive exploration aims to assist taxpayers in making informed decisions regarding their preferred tax regime.

New Tax Regime

The Budget of 2020 introduced a new tax regime with revised tax slabs and concessional tax rates. However, opting for this new regime meant forgoing several exemptions and deductions, such as HRA, LTA, 80C, and 80D. As a result, uptake of the new tax

regime remained limited. To address this, the government made significant changes in the Budget of 2023, which continue unchanged for FY 2024-2025 as no alterations were made in the Interim Budget of 2024.

Here are the key changes introduced to encourage taxpayers to adopt the new regime:

Higher Tax Rebate Limit:The government increased the full tax rebate threshold to an income of ₹7 lakhs, up from ₹5 lakhs under the old tax regime. This means individuals earning up to ₹7 lakhs will not have

to pay any tax under the new tax regime.

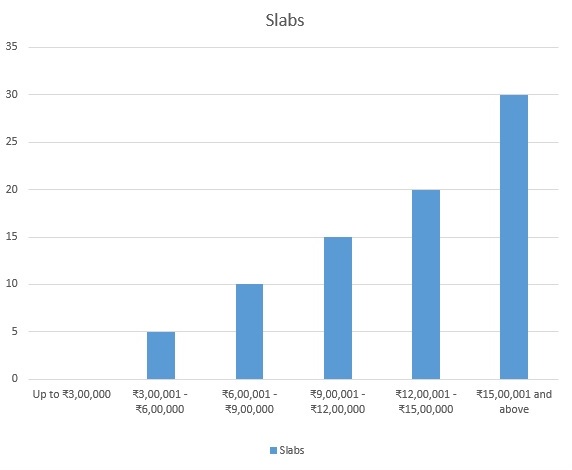

Streamlined Tax Slabs:The tax exemption limit has been raised to ₹3 lakhs. The new tax slabs are as follows:

These tax slabs represent the rates applicable under the new tax regime introduced in the Budget of 2023 for FY 2024-2025.

Old Tax Regime

Under the old tax regime, which was in place before the new regime was introduced, taxpayers have access to a wide range of over 70 exemptions and deductions. These include popular benefits such as the House Rent Allowance (HRA), Leave Travel Allowance

(LTA) and many others to decrease taxable income and reduce tax liabilities.

One of the most significant deductions available under this regime is Section 80C, which allows individuals to claim deductions of up to Rs. 1.5 lakh from their taxable income. This provision encompasses

various investment avenues such as investments in the Public Provident Fund (PPF), Equity Linked Savings Schemes (ELSS), and contributions to the Employee Provident Fund (EPF), among others.

Taxpayers have a choice between the old and the new tax regime, each offering distinct advantages and considerations. While the old regime provides ample opportunities for tax-saving through exemptions

and deductions, individuals must weigh these benefits against the simplicity and potentially lower rates offered by the new regime.

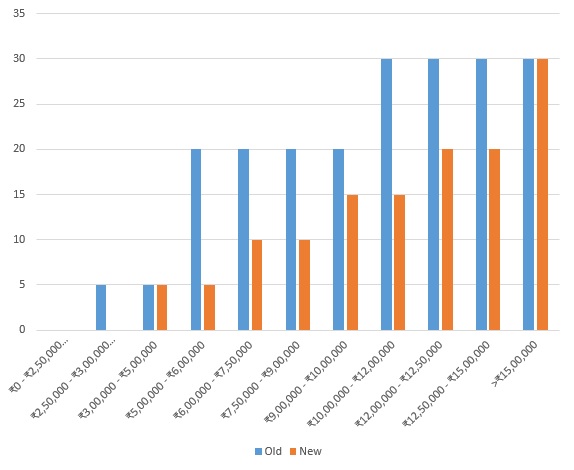

Comparison between the Old tax Regime and New Tax Regime

Tax Benefits and Adjustments:

Standard Deduction and Family Pension Deduction: The standard deduction of ₹50,000 applies to both old and new tax regimes. Family pension recipients can also claim a deduction of ₹15,000 or 1/3rd of the pension, whichever is lower.

Reduced Surcharge for High Net Worth Individuals: The surcharge rate on income over ₹5 crores has been reduced from 37% to 25%, effectively lowering the effective tax rate for high-income individuals from 42.74% to 39%.

Higher Leave Encashment Exemption: The exemption limit for non-government employees for leave encashment has been raised from ₹3 lakhs to ₹25 lakhs, marking an 8-fold increase.

Default Regime: Starting from FY 2023-24, the new income tax regime will be set as the default option. To continue using the old regime, taxpayers must submit the income tax return along with Form 10IEA before the due date. Annual switching between the two regimes is allowed to assess tax benefits.

Difference Between Old Vs New Tax Regime: Which is Better?

Deciding whether to switch to the new tax regime or remain in the old regime depends on the tax savings, deductions, and exemptions you're eligible for under the old tax regime. To simplify this decision-making process, we have calculated breakeven points for various income levels for salaried individuals below 60 years of age. This enables you to determine which regime is more advantageous for you.

Breakeven points for Deciding Between New vs Old Tax Regimes:

The breakeven threshold represents the income threshold where there is no difference in tax liability between the two tax regimes If your total eligible deductions and exemptions in the old tax regime exceed the breakeven threshold for your income level, staying in the old regime is advisable. Conversely, if the breakeven threshold is higher than your eligible deductions and exemptions, moving to the new tax regime becomes more beneficial. This analysis allows you to make an informed decision based on your financial circumstances and tax-saving objectives.

How to Decide Between Old and New Tax Regimes?

When faced with the choice between the old and new tax regimes, it's crucial to consider the available tax exemptions and deductions under the old tax regime. After deducting all eligible exemptions and deductions, you can calculate your net taxable income.

Comparing the tax liability based on this net income under the old tax regime with that under the new tax regime allows for a clear comparison.

Opting for the regime with the lower tax liability is the logical decision. It's essential to inform your employer of this choice to ensure the appropriate Tax Deducted at Source (TDS) is deducted from

your salary.

If you have incurred losses from house property, capital gains, or business & profession, you should factor them into your decision-making process. Additionally, consider that even the previous year's

losses eligible for set-off may lapse. Ineligibility to carry forward such losses could impact future income determination and taxes.

Conclusion

The disparities between the old and new tax regimes often leave individuals questioning which is more advantageous. The new income tax regime is tailored to accommodate individuals with significant personal commitments, such as loan repayments or medical

expenses, or those seeking to simplify tax preparation. Conversely, the old tax regime may offer greater tax savings for senior citizens, especially those deriving income from interest sources, who can benefit from

Section 80TTB.

Both regimes have their pros and cons. The old regime fosters a culture of savings, while the new regime is more favourable for lower-income earners with fewer investments, resulting in fewer deductions.

The new system is deemed safer and simpler, reducing paperwork and minimising the risk of tax evasion. However, due to the individualised nature of deductions and exemptions, a thorough comparison is necessary to

determine the most suitable regime for each person.